Start with thinking outside the box. I’m going to show you a little bank loophole you wish you knew about years ago.

((NOTE: This offer is NO LONGER available – you snooze you lose!))

That’s right. I said 60% interest. Yes, there’s a catch. You can only make the 60% interest on $400.

But hey, 60% annual interest on $400 is still going to earn you an extra $240 a year – risk free. AND there’s virtually no time or effort attached to it after the initial set up.

So where do you get it and how is it done?

Go to Santander Bank’s website: www.santanderbank.com. If you live anywhere near me (Tulsa, OK) then you’re out of luck on a local branch, but for this purpose you don’t need a local branch anyways.

On Santander’s home page you’ll see this:

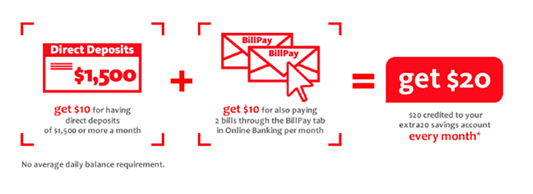

Click on “Learn More” and you’ll see this:

Here’s the fine print breakdown on Santander’s deal to earn the $20/mo and keep it free:

- Have direct deposit(s) totaling $1,500 or more in each statement period into the checking account (See below for how to get it done with only $400.)

- Use its bill payment service to pay two bills each statement period, which can be scheduled as recurring. (I use a recurring $5 payment to my credit card that takes place twice a month.)

- The bank will credit you $20 each month into the savings account after the statement closes.

I’ve had the extra20 package since early 2015. It works exactly as advertised.

So here’s the recipe to get a 60% return on $400 using Santander Bank’s extra20 account, with no fees, no effort after the initial set up, and it’s FDIC insured. 🙂

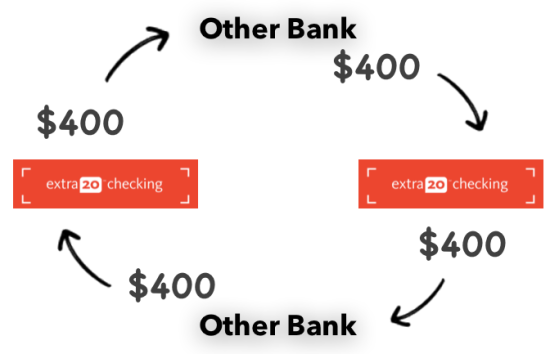

Simply rotate $400 between Santander and another bank account four times a month:

(Ok yes… $400 x 4 = $1600, which is over the $1500 minimum direct deposit requirement for Santander’s promotion. If it makes you sleep better at night, work with $375 instead)

INGREDIENTS NEEDED:

- At least $400.

- A business checking account with another bank. (I recommend Arvest Bank. www.arvest.com. I’ve been using their free business checking account since 2012 )

- About an hour of time for the initial set up.

DIRECTIONS:

- Open the Santander extra20 checking and savings account package following the online instructions on Santander’s website. You’ll need to send in identification documents and wait for three letters to arrive in the mail. The first letter will have your account numbers. The second letter will have your first time login ID when you register for online banking. The third letter will have your temporary password. Once you have all three letters, register for online banking.

- Set up a weekly recurring $400 direct deposit from your business checking account at another bank into your Santander extra20 checking account. (If using Arvest’s free business checking, this must be done in person at a local branch.)

- Set up a weekly recurring $400 ACH transfer from your extra20 Santander checking account back into your external business checking account. (I have an additional $400 in each bank account saved as a buffer just in case one of the banks doesn’t process a transfer on time to prevent any possible unwanted bank fees.)

- Use Santander’s bill payment service to set up two recurring $5 payments each statement period. (Again, I set up my recurring payments to my credit card for simplicity.)

- Set up a recurring $10 transfer from your extra20 savings account unto your extra20 checking account to cover the two recurring $5 payments you set up in step 4.

That’s it. You’re done.

Now you’re making an extra $240 in passive income each year on a revolving $400 between two bank accounts.

Thank you! I do have to apologize though as I believe this account with Santander is no longer offered. I should have some more updated posts soon!