After you read this, you’ll never want to use a normal Piggy Bank again.

We’ve all had one, used one, thought about one, or (sadly) broken one at some point in our lives.

Here’s a few reasons why I DON’T like standard piggy banks:

• You can’t fit much money in them

• They don’t bear any kind of interest

• They are too easy to break into

Every time you physically walk over to little Mr. Piggy and put a few dollars in him, you’ve waisted about 30 seconds of your life. Yeah that’s not a lot of time – but if you’re saving as often as you should be – that 30 seconds is going to add up FAST. 30 seconds x 365 days a year = 182.5 minutes. I don’t know about you, but I’d rather spend that 180 minutes doing something a little more productive (or fun). 🙂

And keep in mind that every time you see Mr. Piggy, you’re reminded there’s a few bucks in there. When you know there’s a few bucks in there, it’s easy to be tempted with pulling a couple dollars out the next time you’re thirsty, need $5, or need some change for the toll booth.

Solution

It’s 2017. We all have Smart Phones. It’s time our Piggy Banks got smart too.

Introducing my friend: SmartyPig.

What is SmartyPig?

SmartyPig is an online Piggy Bank for people saving for specific goals like a vacation, a new mountain bike, down payment on a house, emergency fund, or even starting a family. You can set up automatic recurring savings, it bears a decent interest rate, and is FDIC insured. You can add or withdraw funds to your account at any time. Oh and did I mention it’s free?

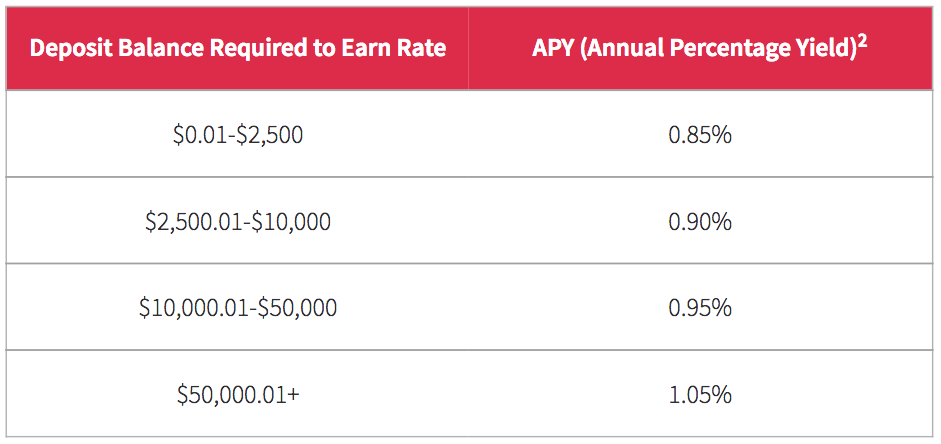

With their tiered interest rates, the more you save, the more you earn!

I don’t recommend saving larger chunks of cash here in order to yield the higher interest rates as you can get a better rate elsewhere. I use SmartyPig as a place to have liquid cash that builds interest while not having to worry about paying any kind of penalty to have access to it.

Here’s a few reasons why I have a SmartyPig account:

• It saves me time. Set it up once and forget about it. Next thing you know, you’ve got a decent amount of cash growing on the side.

• It’s another place to hide money from myself. This is something I learned from my grandparents. If you have multiple bank accounts and places to stash your cash, it’s easy to hide money from yourself. You don’t think you have as much money so it’s easier to not spend as much.

• It’s a great place for an Emergency Fund (or Investment Opportunity Fund!). Everybody should have an Emergency Fund of some kind. It’s only a matter of time before a rainy day comes around and it’s always better to have the cash set aside. Interest either works for you or against you. Save your money and it works for you. Go into debt and it works against you.

Don’t just take my word for it. Go try it out for yourself. You can open an account with no obligation and browse around their site before making a deposit.